Bitcoin (BTC) remains in a consolidation phase following the October 10 market crash, with bulls now pushing prices back above critical resistance levels. The recovery toward the $115K region has renewed optimism across the market, as the monthly close approaches and traders anticipate a possible shift in momentum.

According to several analysts, this phase may represent the calm before the storm, a typical pattern seen before large directional moves. On-chain data and liquidity metrics suggest that capital is accumulating on the sidelines, ready to rotate into Bitcoin once clear bullish confirmation appears.

If BTC manages to break above its previous all-time high (ATH), analysts believe it could trigger a new impulsive phase, similar to the post-accumulation surges observed in earlier bull cycles. Funding rates remain stable, suggesting that leverage is still moderate — a positive sign for a potential sustainable rally.

Furthermore, liquidity concentration near key resistance zones indicates that a decisive breakout could quickly attract institutional and retail inflows. As volatility compresses and the market digests recent shocks, Bitcoin appears to be building strength for its next major move, with liquidity and sentiment aligned for a possible bullish continuation into November.

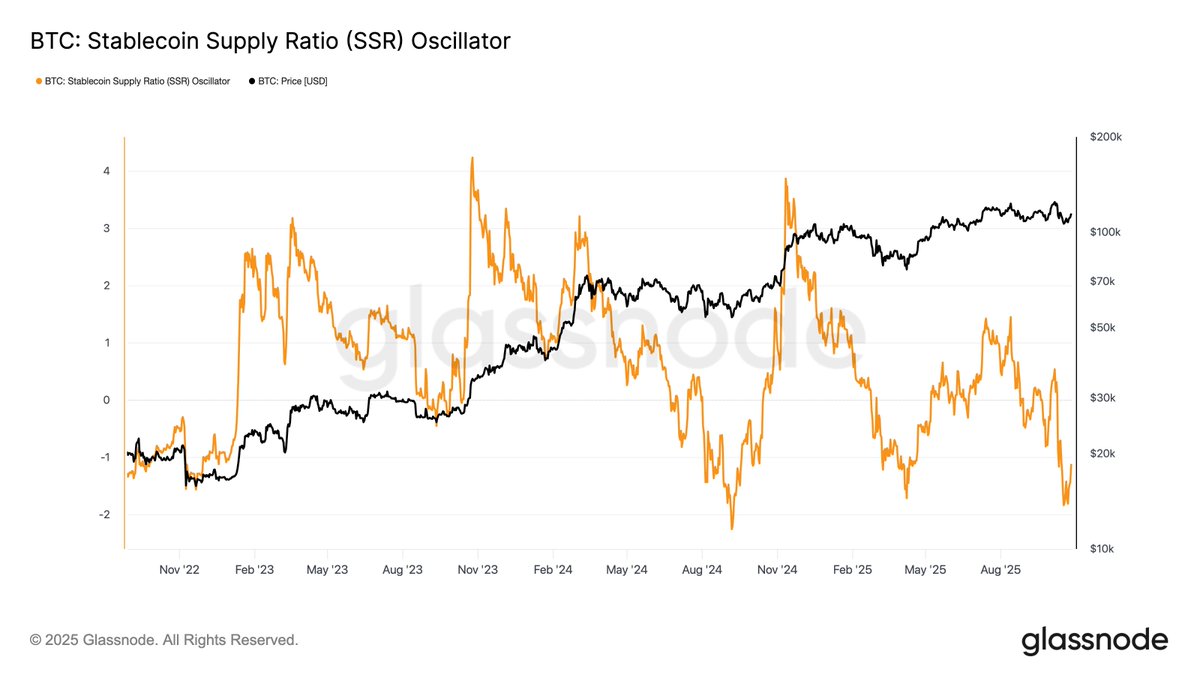

Bitcoin Liquidity Builds as Stablecoin Supply Ratio Hits Cycle Lows

According to Glassnode data, the Stablecoin Supply Ratio (SSR) Oscillator remains near its cycle lows, signaling a period of high stablecoin liquidity relative to Bitcoin’s market capitalization. In simple terms, this means there is a substantial amount of buying power sitting in stablecoins — the digital cash reserves of the crypto ecosystem — waiting for the right moment to re-enter the market.

Historically, such conditions have often preceded major bullish phases for Bitcoin. When stablecoin liquidity is high, it implies that investors are holding capital in readiness rather than fleeing the market entirely. Once market confidence strengthens, these reserves typically flow back into risk assets like Bitcoin and Ethereum, creating a wave of bid-side pressure that fuels upward momentum.

At the moment, Bitcoin is trading just above $115K, still recovering from the October 10 crash that disrupted short-term sentiment. Yet, despite recent volatility, liquidity indicators such as the SSR suggest that the market’s underlying structure remains healthy. Stablecoins now represent a significant portion of total crypto liquidity, and their abundance indicates that participants are positioned to buy the dip once conviction returns.

Analysts interpret the current SSR trend as a bullish latent signal, reflecting a macro setup similar to those seen before previous expansion phases. If Bitcoin manages to stabilize and reclaim higher levels, the excess liquidity sitting in stablecoins could act as a catalyst for a strong impulse move, driving BTC toward a new cycle high. In this context, the SSR’s position near historical lows might represent not just a sign of caution, but an early signal that the next major liquidity-driven rally could already be forming beneath the surface.

BTC Retests Resistance as Bulls Regain Control

Bitcoin (BTC) continues its recovery, trading around $115,300 after a strong rebound from the $108K region earlier this month. The 12-hour chart reveals a clear upward structure forming, with bulls now challenging the $117,500 resistance level, a zone that has repeatedly acted as both support and rejection in recent months.

BTC is currently trading above the 50-day and 100-day moving averages, signaling renewed short-term strength, while the 200-day MA around $113K has turned into a solid support base. A sustained breakout above $117.5K could open the door for a move toward $120K–$123K, confirming a short-term impulsive phase and potentially restoring investor confidence after weeks of consolidation.

Volume has been rising alongside price, suggesting genuine buying interest rather than speculative spikes. However, BTC’s momentum remains sensitive to macroeconomic factors and liquidity conditions. A rejection at this level could lead to another retest of $111K, maintaining the consolidation range.

Overall, Bitcoin’s current technical structure looks constructively bullish. If price manages to close above $117.5K with strong volume, it would likely confirm the end of the post-crash stagnation and set the stage for a new leg higher, supported by improving liquidity and market sentiment.

Featured image from ChatGPT, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

#SSR #Oscillator #Signals #Liquidity #Waiting #Enter #Bitcoin #Details