In brief

- Dalio said CBDCs could give governments unprecedented ability to monitor transactions and enforce policy through the financial system.

- He played down their long-term appeal as a store of value, arguing they would struggle to compete with money-market funds or bonds.

- The comments come as dozens of countries advance CBDC pilots, reviving debate over privacy, control and the future role of decentralized alternatives like Bitcoin.

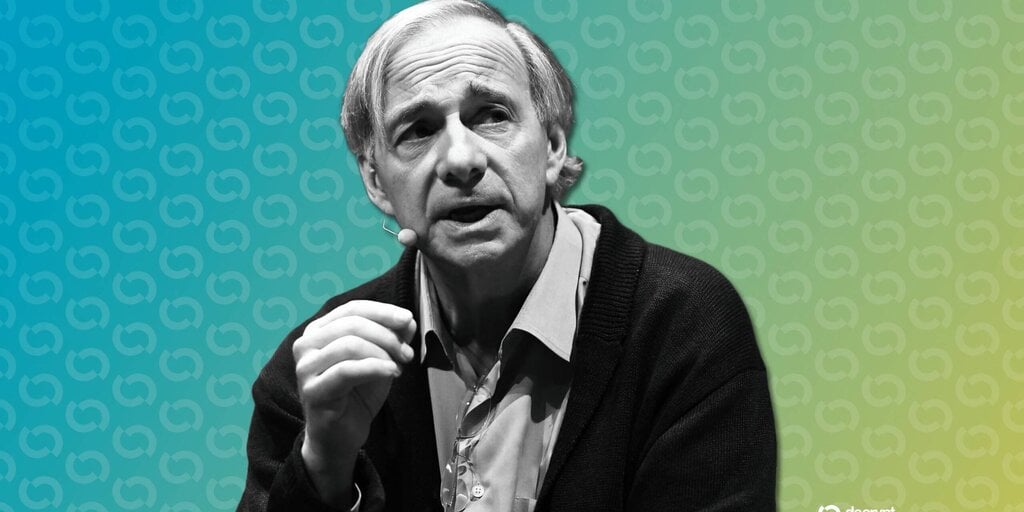

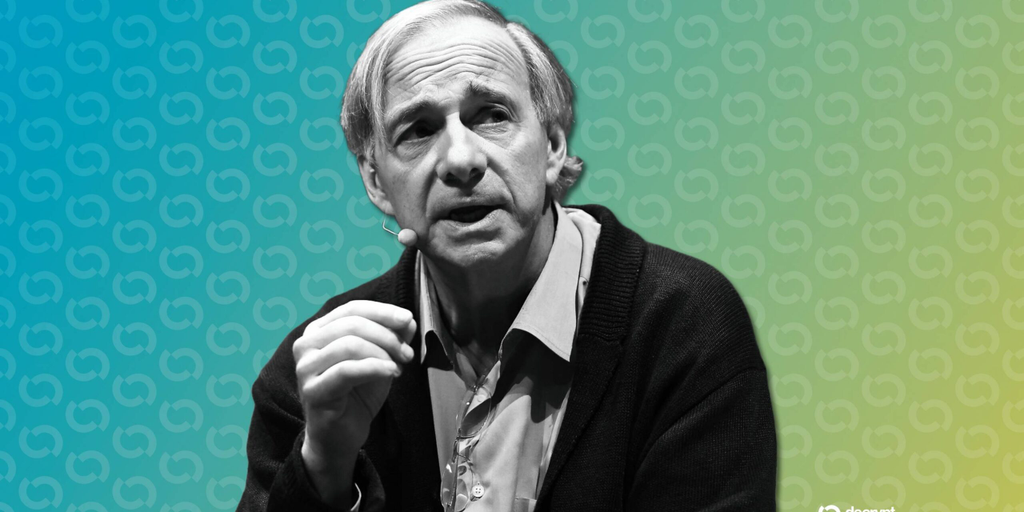

Bridgewater Associates founder Ray Dalio warned Monday that central bank digital currencies would give governments far greater visibility into financial activity, even as he played down their likely scale.

Speaking in an interview with Tucker Carlson, Dalio said CBDCs “will be done” in the foreseeable future but are unlikely to become “that big of a deal,” adding they could function like money-market funds while offering governments tighter control over transactions.

“There will be a debate; probably they won’t be [offering interest], then they’re not an effective vehicle to hold because you’ll have depreciation,” he said. “You’d rather hold in a money market fund or a bond.”

While acknowledging that “there’s a great deal of appeal” in CBDCs because they’re “easy” and convenient, Dalio said they’re a “very effective controlling mechanism by the government.”

Complete transparency will be good for tracking and reducing illegal activities, but would also mean “the government has a great deal of control,” he said. “What I mean is all the transactions will be known.”

Such control will extend into other areas, with CBDCs potentially being used by governments to automatically levy taxes and apply foreign exchange controls, he said.

He added that CBDCs could allow governments to automatically enforce sanctions, restrict access for politically disfavoured groups, levy taxes and impose foreign-exchange controls.

Dalio’s comments come as more than 130 countries or currency unions are at various stages of exploration, with 72 currently in advanced phases of development, according to the Atlantic Council.

The figures include three countries, the Bahamas, Jamaica, and Nigeria, that have formally launched CBDCs, as well as 49 jurisdictions, including China, that are running pilot programs.

Dalio’s concerns echo views long held by parts of the blockchain industry, though critics frame the issue less as surveillance and more as a structural design issue.

Harry Halpin, chief executive of decentralized mix-network provider Nym Technologies, said the core infrastructure required for CBDCs already exists within the banking system.

“Digital technology is already used by central banks like the Fed to monitor relationships with commercial banks,” Halpin told Decrypt. “It’s a very small step to extend that visibility to individual accounts through a CBDC.”

Halpin said privacy-focused cryptocurrencies were designed to address those concerns, though such tools remain controversial with regulators.

Halpin contrasted the model with Bitcoin, whose decentralized architecture limits the ability of any single authority to monitor or restrict transactions, saying CBDCs represent “the opposite” of the system envisioned by Bitcoin’s creator.

Dalio has, in recent years, softened toward Bitcoin as a portfolio diversifier, even as he continues to stress its limitations.

He has said he holds a small allocation in the asset and that investors should pay attention to it as an alternative form of money, and at times has expressed a preference for Bitcoin and gold over traditional debt instruments like bonds.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.