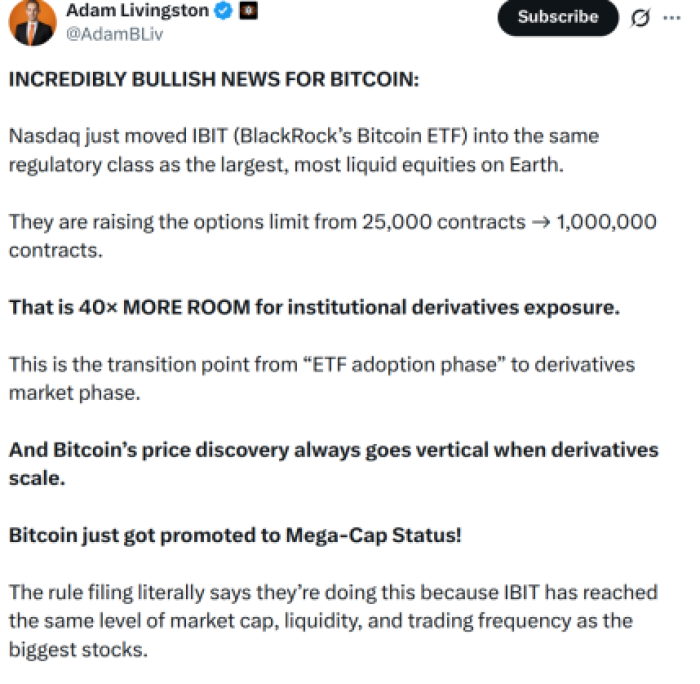

Quick Facts:

- ➡️ Nasdaq’s plan for a one million contract limit on BlackRock’s Bitcoin ETF options signals deeper institutional derivatives flow into $BTC over time.

- ➡️ Expanded Bitcoin options capacity has historically coincided with stronger volatility regimes, often driving capital into higher‑beta meme and narrative coins.

- ➡️ PEPENODE proposes a virtual mining meme coin ecosystem where tiered nodes and gamified rewards target boring mining models and weak early user incentives.

The Nasdaq just made a massive move.

It set a 1M-contract limit on BlackRock’s Bitcoin ETF (IBIT) options.

This is Nasdaq clearing the runway for some serious heavy hitters. By cranking up the limits this aggressively, they are basically rolling out the red carpet for macro funds, volatility desks, and the big-money structured product guys to pile into Bitcoin like never before.

The change officially puts $BTC on the map as a legit institutional playground, not just a side-show for spot traders. Sure, bigger capacity means deeper order books, which is great, but the real story is the leverage.

This scale allows the big funds to run complex strategies, like basis trades, that dump a ton of persistent gamma flows into the market. Historically, when you get that much one-sided action in the derivatives market, it acts like rocket fuel.

X analysts quickly pounced on the news, some highlighted that $IBIT is now the largest $BTC options market in the world by open interest (OI). Whilst others broke down what the action means, citing it as bullish Bitcoin news.

Now we could start to see traders start rotating their profits out of ‘safe’ $BTC bets and go hunting for asymmetric gains in the wilder corners of the market. The money flows down the risk curve, first into leveraged perps, and then straight into meme coins and narrative plays.

PEPENODE: Catching the Wave with a ‘Mine-to-Earn’ Twist

With all that capital likely looking for the next big thing outside of Bitcoin, PEPENODE ($PEPENODE) is stepping up to catch the rotation.

It’s pitched as the world’s first ‘mine-to-earn’ meme coin. The idea is pretty clever: while most meme coins are just about community hype and vibes, $PEPENODE is trying to ground that speculation in a gamified system that feels like crypto mining, but without the headache.

The project is built around a Virtual Mining System. Forget about buying expensive ASIC rigs, dealing with insane electricity bills, or setting up cooling fans in your garage. Instead, you just hop onto a slick, gamified dashboard where you can buy and customize ‘Miner Nodes.’

You can upgrade these digital facilities to boost your stats, which directly pumps your yield. It’s a smart pivot because it takes the usually dry, technical world of DeFi yield farming and turns it into an addictive management game.

By mashing up meme culture with sticky gameplay mechanics, PEPENODE is trying to solve the classic farm and dump problem. You aren’t just staking tokens; you’re building a virtual empire.

Plus, active players earn rewards not just in $PEPENODE, but also in other blue-chip memes like PEPE and Fartcoin. It creates a loop where playing the game actually feeds demand for the token.

$PEPENODE: It’s All About the Numbers

The gameplay sounds fun, but let’s talk numbers specifically regarding the $PEPENODE token, which is the engine running this whole thing. It’s the currency you need for staking, rewards, and governance, and right now, the presale is seeing some serious action.

Smart money seems to be positioning itself ahead of the Token Generation Event (TGE). The presale has already raked in over $2.2M, and costing only $0.0011685, it’s one of the best low-cap coins.

This entry point is basically the early bird special before all the fancy node utilities and gameplay features actually go live. This pre-activation phase is a golden chance for you to front-run the narrative before the rest of the market catches on to the whole mine-to-earn trend.

The on-chain data backs this up, too. We’ve seen whale wallets scoop up large chunks as high as $94.1K worth of $PEPENODE recently. That’s a strong signal that some big wallets are betting on upside that goes beyond your typical meme coin pump.

Our experts see the same. In our ‘PEPENODE Price Prediction’, where EOY predictions for 2026, see $PEPENODE potentially reading $0.0072. That would be an ROI of 516% if you invested at today’s price.

These guys are likely wagering that if institutional flows send the market higher, gamified projects like this will outperform static coins. If you’re looking for a high-beta play, it might be time to check out the $PEPENODE presale.

Remember, this is not intended as financial advice, and you should always do your own research before making any investments.

Authored by Ben Wallis, Bitcoinist – https://bitcoinist.com/pepenode-presale-pops-as-nasdaq-1m-bitcoin-etf-options-limit-ignites-institutional-flows/

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

#Nasdaq #Bitcoin #ETF #Options #Limit #Ignites #Institutional #Flows #PEPENODE #Presale #Pops