As the world shifts from a U.S.-dominated unipolar order to a multipolar landscape led by BRICS nations, the U.S. dollar faces unprecedented pressure from declining bond demand and rising debt costs. The Genius Act, passed in July 2025, signals a bold U.S. strategy to counter this by legalizing Treasury-backed stablecoins, unlocking billions in foreign demand for U.S. bonds.

The blockchain hosting these stablecoins will shape the global economy for decades. Bitcoin, with its unmatched decentralization, Lightning Network privacy, and robust security, emerges as the superior choice to power this digital dollar revolution, ensuring low switching costs when fiat inevitably fades. This essay explores why the dollar must and will become digitized via blockchains and why Bitcoin must become its rails for the U.S. economy to have a soft landing from the highs of being a global empire.

End of the Unipolar World

You might have heard that the world is transitioning from a unipolar world order — where the United States was the only superpower and could make or break markets and dominate conflicts across the globe — to a multipolar world, where a union of Eastern-allied countries can organize despite U.S. foreign policy. This eastern alliance is called BRICS and is made up of major countries like Brazil, Russia, China and India. The inevitable consequence of the rise of BRICS is the restructuring of geopolitics, posing a challenge to the hegemony of the U.S. dollar system.

There are many apparently isolated data points that signal this restructuring of the world order. Take, for example, the United States’ military alliance with a country like Saudi Arabia. The U.S. is no longer defending the petrodollar agreement, which saw Saudi oil sold only for dollars in exchange for military defense of the region. The petrodollar strategy was a major source of demand for the dollar and was considered pivotal to the strength of the U.S. economy since the ’70s, but has effectively ended in recent years — at least since the start of the Ukraine war, when Saudi Arabia began accepting currencies other than the dollar for oil-related trades.

The Weakening of the U.S. Bond Market

Another critical data point in the geopolitical change of the world order is the weakening of the U.S. bond market. Doubts about the long-term creditworthiness of the U.S. government are growing. Some have concerns about the country’s internal political instability, while others are skeptical that the current government structure can adapt to the rapidly changing, high-tech world and the rise of BRICS.

Elon Musk, reportedly the richest man in the world and arguably the most effective CEO in history, capable of running multiple seemingly impossible companies simultaneously — such as SpaceX, Tesla, The Boring Company and X.com — is one of these skeptics. Musk recently spent months with the Trump administration figuring out how to restructure the federal government and the country’s financial position via DOGE, the Department Of Government Efficiency, before an abrupt exit from politics in May.

Musk recently shocked the internet in an All-In Summit appearance where he commented on his experience on the matter, saying, “I haven’t been to DC since May. The government is basically unfixable. I applaud David (Sacks’) noble efforts… but at the end of the day, if you look at our national debt.. .if AI and robots don’t solve our national debt, we’re toast.”

If Elon Musk can’t get the U.S. government to pivot away from financial doom, who can?

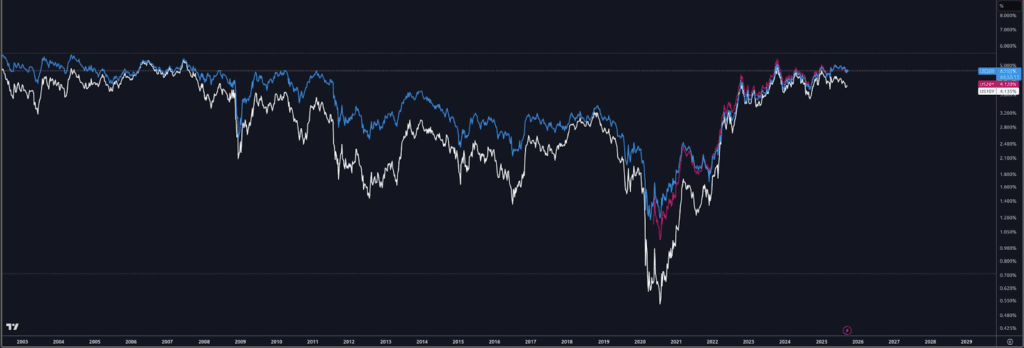

Doubts of this sort are reflected in the low demand for long-term U.S. bonds, as evidenced by the need for higher interest rates to attract investors. Today, the US30Y is at 4.75%, a 17-year high. Demand in long-dated auctions of U.S. bonds, like the US30Y, has also trended downward with “disappointing” demand in 2025, according to Reuters.

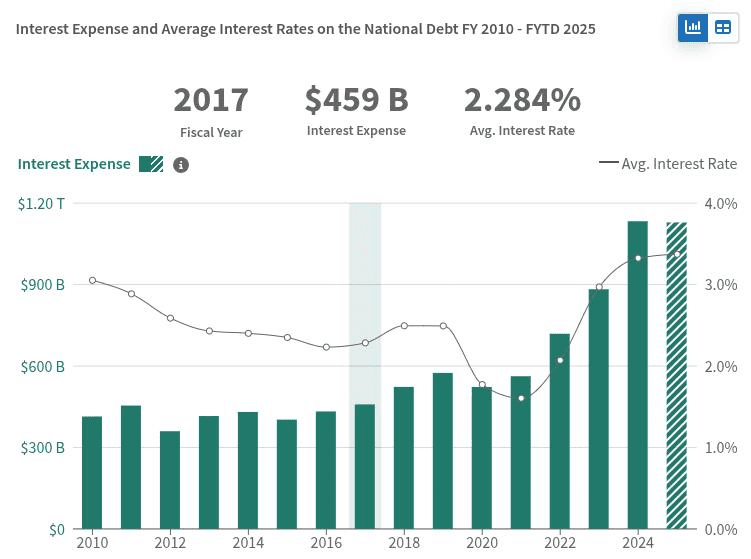

The weakening demand for long-dated U.S. bonds has significant consequences for the U.S. economy. The U.S. Treasury has to offer higher interest rates to entice investors, in turn increasing the payments the U.S. government has to make on the interest of the national debt. Today, the U.S. interest payments are close to one trillion dollars a year, more than the whole military budget of the country.

If the United States fails to find enough buyers for its future debt, it may struggle to pay its immediate bills, having to rely instead on the Fed to buy that debt, which expands its balance sheet and the money supply. The effects, though complex, would likely be inflationary on the dollar, further harming the U.S. economy.

How Sanctions Wounded the Bond Market

Further weakening the U.S. bond market, in 2022, the United States manipulated the U.S.-controlled bond market rails against Russia in response to its invasion of Ukraine. As the Russians invaded, the U.S. froze Russian treasury reserves held overseas, which were intended in part to pay its national debt to Western investors. In what looks like an attempt to force Russia into a default, the U.S. also reportedly began blocking all attempts made by Russia to pay off its own debt to foreign bondholders.

A U.S. Treasury spokeswoman confirmed at the time that certain payments were no longer being allowed.

“Today is the deadline for Russia to make another debt payment,” the spokeswoman said.

“Beginning today, the U.S. Treasury will not permit any dollar debt payments to be made from Russian government accounts at U.S. financial institutions. Russia must choose between draining remaining valuable dollar reserves or new revenue coming in, or default.”

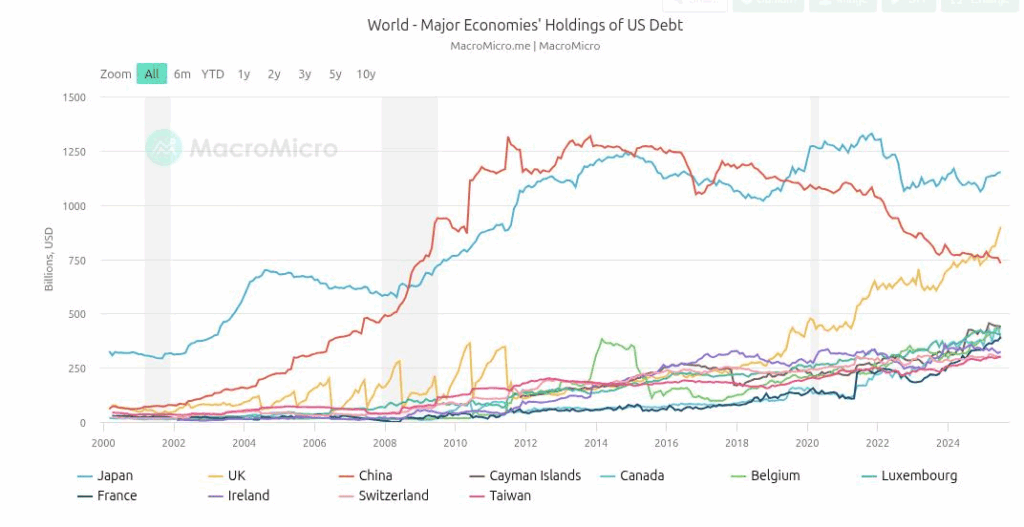

The U.S. effectively weaponized the bond market against Russia through a novel use of its foreign policy sanctions regime. But sanctions are a double-edged sword: Since then, foreign demand for U.S. bonds has weakened as nations not aligned with U.S. foreign policy looked to diversify their risk. China has led this trend away from U.S. bonds, its holdings peaked in 2013 at over 1.25 trillion dollars and has accelerated downward since the beginning of the Ukraine war, sitting today at close to 750 billion.

While this event demonstrated the devastating effectiveness of sanctions, it also deeply wounded confidence in the bond market. Not only was Russia blocked from paying off its debts under the Biden administration sanctions, also harming investors as collateral damage, but the freezing of its foreign treasury reserves showed the world that if you, as a sovereign nation, go against U.S. foreign policy, all bets are off — and that includes the bond market.

Following the arguable overreach of sanctions from the previous administration, the Trump admin has backed off from sanctions as a strategy, since they harm the U.S. financial sector, and pivoted to a tariff-based approach to foreign policy. These tariffs so far have had mixed results. While the Trump administration boasts record revenue and infrastructure investments by the private sector in the country, Eastern nations have accelerated their collaboration through the BRICS alliance.

The recent SCO summit in Tianjin, China, brought together world leaders, including Chinese President Xi Jinping, Russian President Vladimir Putin and Prime Minister of India Narendra Modi, among others. The most notable news to come out of the SCO summit was a joint pledge by India and China to be “partners not rivals,” a further step toward the multipolar world order.

The Stablecoin Playbook

While China has divested from U.S. bonds in the past decade, a new buyer has emerged, quickly entering the top echelons of power. Tether, a financial technology company born in the early days of Bitcoin and originally built on top of its network through the Mastercoin layer-two protocol, today owns $171 billion worth of U.S. bonds, close to a quarter of the amount China owns and more than most other countries.

Tether is the issuer of the most popular stablecoin, USDT, with a market cap of 171 billion dollars in value in circulation, equivalent to its reported bond holdings. The company reported $1 billion in profits for Q1 of 2025, with a simple yet brilliant business model: buy short-dated U.S. bonds, emit USDT tokens backed 1-for-1, and pocket the coupon interest payments from the U.S. government. With 100 employees at the beginning of the year, Tether is said to be one of the most profitable companies per employee in the world.

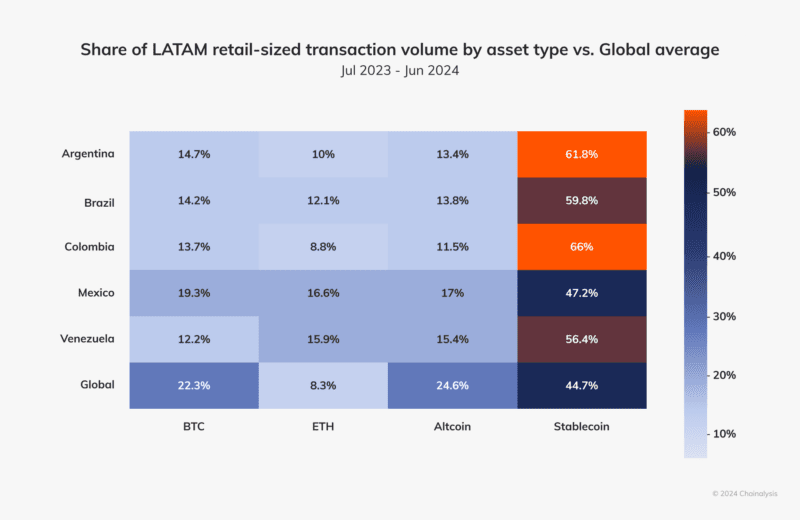

Circle, the issuer of USDC and the second-most popular stablecoin in the market, also holds close to $50 billion in short-dated treasuries. Stablecoins are used all over the world, particularly in Latin America and developing nations, as an alternative to local fiat currencies, which suffer far deeper inflation than the dollar and are often hindered by capital controls.

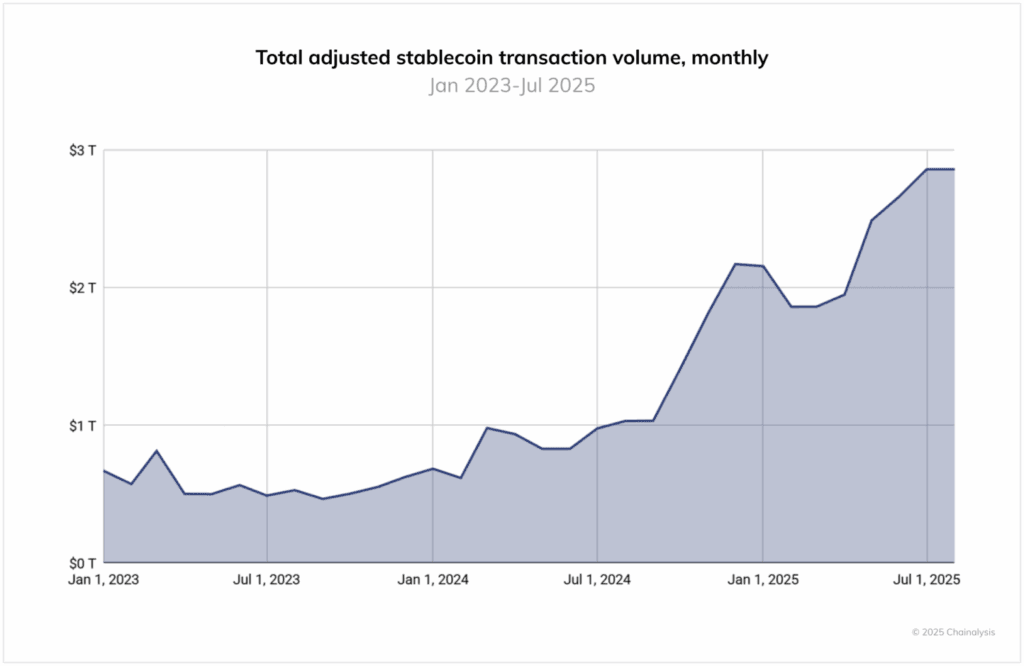

The volume processed by stablecoins today is beyond a niche, nerd financial toy; it is in the trillions of dollars. A 2025 Chainalysis report states, “Between June 2024 and June 2025, USDT processed over $1 trillion per month, peaking at $1.14T in January 2025. USDC, meanwhile, ranged from $1.24T to $3.29T monthly. These volumes highlight the continued centrality of Tether and USDC in crypto market infrastructure, especially for cross-border payments and institutional activity.”

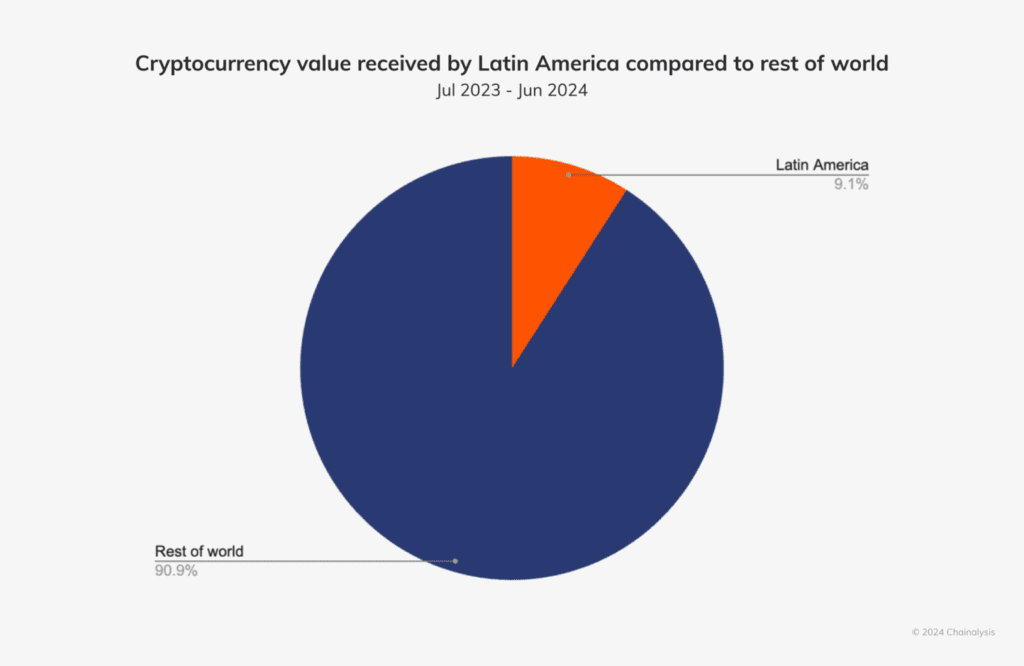

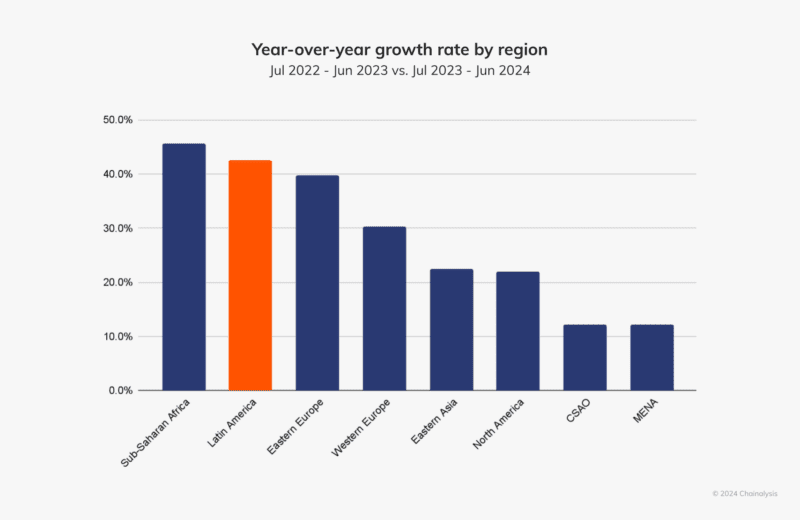

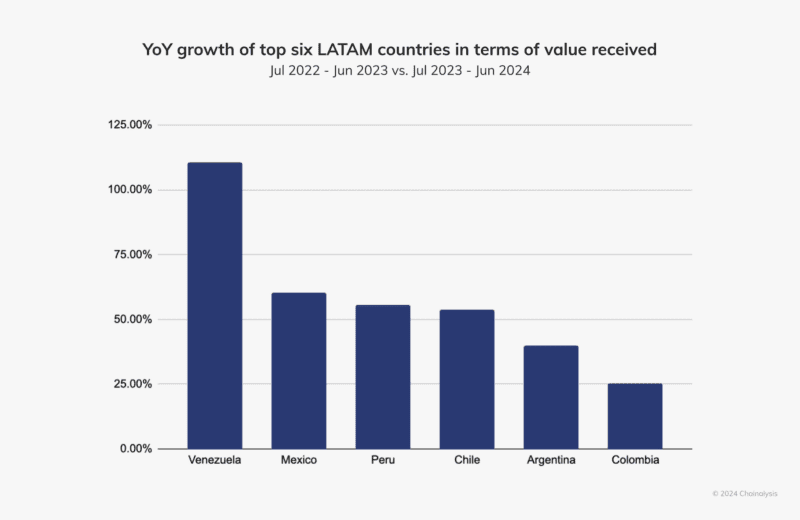

Latin America, for example, accounted for 9.1% of total crypto value received between 2023 and 2024, with year-to-year usage growth rates of 40-100%, of which over 50% were stablecoins, according to a 2024 Latin America-focused report by Chainalysis, demonstrating the strong demand for alternative currencies in the developing world.

The U.S. needs new demand for its bonds, and that demand exists in the form of demand for the dollar, given that most people throughout the world are locked into fiat currencies that are far inferior to those of the United States. If the world transitions to a geopolitical structure that forces the dollar to compete on even terms with all other fiat currencies, it nevertheless may continue to be the best among them. The United States, for all its faults, remains a superpower, with incredible wealth, human capital and economic potential, particularly when compared to many smaller countries and their questionable pesos.

Latin America has demonstrated a deep hunger for the dollar, but there’s a supply problem as local nations resist legacy banking dollar rails. Getting access to dollar-denominated accounts in many countries outside of the United States is not easy. Local banks are often tightly regulated and serve at the behest of local governments, who also have an interest in defending their peso. The U.S. is not the only government that understands the value of printing money and defending its value, after all.

Stablecoins, leveraging the censorship-resistant qualities of their underlying blockchains, can provide individuals plausible deniability and privacy from their local state, a feature that local banks cannot provide. As a result, the U.S., through the promotion of stablecoins, can access foreign markets it has yet to reach, expanding its demand and user base, while also exporting dollar inflation to nations that do not have a direct influence on American politics — a long tradition in the history of the USD. From a strategic perspective, this sounds ideal for the United States, and it is a simple extension of how the USD has worked for decades, just on top of new financial technology.

The U.S. government understands this opportunity. According to Chainalysis, “The stablecoin regulatory landscape has evolved significantly over the past 12 months. While the GENIUS Act in the U.S. (which legalized U.S. bond-backed stablecoins) has not yet taken effect, its passage has driven strong institutional interest.”

Why Stablecoins Should Ride On Top of Bitcoin

The best way to make sure Bitcoin benefits from the elevation of the developing world out of mediocre fiat currencies is to make sure the dollar uses Bitcoin as its rails. Every dollar stablecoin wallet should be a Bitcoin wallet as well.

Critics of the Bitcoin dollar strategy will say that it goes against Bitcoin’s libertarian roots, that Bitcoin was supposed to replace the dollar — not enhance it or bring it into the 21st century. However, this concern is largely U.S.-centric. It is easy to condemn the dollar when you get paid in dollars and your bank accounts are denominated in USD. It is easy to critique a 2-8% dollar inflation rate (depending on how you measure it) when that’s your local currency. In too many countries outside of the U.S., 2-8% yearly inflation would be a blessing.

A large portion of the population of the world suffers from fiat currencies far worse than the dollar, with inflation rates in the low-to-high double digits and even triple digits, which is why stablecoins have already gained massive adoption throughout the third world. The developing world needs to get off the sinking ship first. The hope is that once they are on a stable boat, they might start looking around for ways to upgrade to the Bitcoin yacht.

Unfortunately, most stablecoins are not on top of Bitcoin today, despite having started on Bitcoin, a technical reality that is a big source of friction and risk for users. The majority of the stablecoin volume today runs on the Tron blockchain, which is a centralized network run on a handful of servers by Justin Sun, a Chinese national who can be easily targeted by foreign states that dislike the spread of dollar stablecoins inside their borders.

Most of the blockchains on top of which stablecoins move today are also totally transparent. Public addresses, which serve as account numbers for their users, are publicly trackable, often linked by local exchanges to the user’s personal data, and easily accessible by local governments. That’s a lever foreign nations can use to push back on the spread of dollar-denominated stablecoins.

Bitcoin does not have these infrastructure risks. Unlike Ethereum, Tron, Solana, etc., Bitcoin is highly decentralized, with tens of thousands of copies of itself throughout the world and a robust peer-to-peer network used to transmit transactions in a way that can easily route around any bottlenecks or choke points. Its proof-of-work layer provides a separation of powers that other proof-of-stake blockchains do not have. Michael Saylor, for example, despite his massive stack of bitcoins, 3% of the total supply, does not have a direct vote on the consensus politics of the network. The same can not be said for Vitalik, and the proof-of-stake consensus politics of Ethereum, or Justin Sun and Tron.

Furthermore, the Lightning Network on top of Bitcoin unlocks instant transaction settlement, which benefits from Bitcoin’s underlying blockchain security. While also providing users significant privacy, as all Lightning Network transactions are off-chain by design, and do not leave an eternal footprint on its public blockchain. This fundamental difference in approach to payments grants users privacy from those they send money to, as well as from third-party observers who do not run Lightning wallets or high-liquidity Lightning nodes. This reduces the number of threat actors that can invade user privacy from anyone who feels like looking at the blockchain, to a handful of highly competent entrepreneurs and technology firms, at worst.

Users can also run their own Lightning nodes locally and choose how they connect to the network, and plenty of people do, taking their privacy and security into their own hands. None of these qualities can be seen in the blockchains that most people use for stablecoins today.

Compliance policies and even sanctions could still be applied to dollar stablecoins, their governance anchored to Washington, with the same analytics and smart-contract-based approaches used today to stop criminal use of stablecoins. There’s no fundamental way to decentralize something like the dollar; after all, it is centralized by design. However, if most of the stablecoin value were to be transferred over the Lightning Network instead, user privacy could also be maintained, protecting users in developing nations from organized crime and even their local governments.

Ultimately, what users care about is transaction fees — the cost of moving their money around — which is why Tron has dominated the market so far. However, with USDT coming online on top of the Lightning Network, that could soon change. In the Bitcoin dollar world order, the Bitcoin network would become the medium of exchange of the dollar, while the dollar would remain, for the foreseeable future, as the unit of account.

Can Bitcoin Survive This?

Critics of this strategy are also concerned about the impact the Bitcoin dollar strategy may have on Bitcoin itself. They wonder if putting the heavy incentives of the dollar on top of Bitcoin can distort its underlying structure. The most obvious way in which a superpower like the U.S. government might want to manipulate Bitcoin is to bend it into compliance with sanctions regimes, something they could theoretically do at the proof-of-work layer.

However, as discussed earlier, the sanctions regime has arguably already peaked, giving way to the era of tariffs, which seek to control the flow of goods rather than the flow of funds. This post-Trump, post-Ukraine war shift in U.S. foreign policy strategy actually relieves pressure off Bitcoin.

https://bitcoinmagazine.com/culture/the-birth-of-the-bitcoin-dollar

Furthermore, as major Western corporations, such as BlackRock, and even the U.S. government, continue to adopt bitcoin as long-term investments, or, in the words of President Donald J. Trump, a “Strategic Bitcoin Reserve,” they too start to align with the future success and survival of the Bitcoin network. Attacking Bitcoin’s censorship resistance qualities would not only undermine their investment in the asset but would also weaken the network’s ability to deliver stablecoins to the developing world.

The most obvious compromise that Bitcoin would have to make in the Bitcoin dollar world order is to give up the unit of account dimension of money. This is bad news for many Bitcoiners, and rightfully so. Unit of account is the mecca of hyperbitcoinization, and many of its users live in that world today, as they calculate their economic decisions based on the ultimate impact on the amount of sats they hold. However, nothing can really take that away from those who understand Bitcoin as the most sound money to have ever existed. In fact, the conviction of Bitcoin as a store of value and a medium of exchange will be reinforced with this Bitcoin dollar strategy.

Sadly, after 16 years of attempts to make bitcoin a unit of account as ubiquitous as the dollar, some are recognizing that in the medium term, the dollar and stablecoins will likely fulfill that use case. Bitcoin payments will never go away, and bitcoiner-led companies will continue to rise and should continue to accept bitcoin as payment to build up their bitcoin treasuries — but stablecoins and dollar-denominated value will likely dominate crypto trade in the coming decades.

Nothing Stops This Train

As the world continues to adapt to the rising powers in the east and the emergence of the multipolar world order, the United States will likely have to make difficult and pivotal decisions to avoid a long-lasting financial crisis. The country could, in theory, lower its spending, pivot, and restructure in order to become more efficient and competitive in the 21st century. And the Trump administration is certainly trying to do just that, as seen by the tariff regime and other related efforts, which attempt to bring back manufacturing of essential industries into the United States and bolster its local talent. However, in the now legendary words of Lyn Alden, nothing stops this train.

While there are a few miracles that perhaps could solve the United States’ financial woes, such as the science-fiction-like automation of labor and intelligence, and even the Bitcoin dollar strategy, ultimately, even putting the dollar on the blockchain won’t change its fate: to become a collectible for history buffs, a rediscovered token of an ancient empire fit for a museum.

The dollar’s centralized design and dependence on American politics ultimately doom the dollar as a currency, but if we are realistic, its demise might not be seen for another 10, 50 or even 100 years. When the time does come, if history repeats, Bitcoin should be there as the rails, ready to pick up the pieces and fulfill the prophecy of hyperbitcoinization.

BM Big Reads are weekly, in-depth articles on some current topic relevant to Bitcoin and Bitcoiners. Opinions expressed are those of the authors and do not necessarily reflect those of BTC Inc or Bitcoin Magazine. If you have a submission you think fits the model, feel free to reach out at editor[at]bitcoinmagazine.com.

#Genius #Act #Paves #Bitcoin #Dominate #Global #Infrastructure