Arthur Hayes centers Bitcoin as the primary beneficiary of what he calls an inevitable ECB money-printing cycle triggered by France’s worsening funding position, capital flight, and political stalemate.

In his Oct. 2, 2025 essay “Bastille Day,” Hayes argues that the developing fracture is not merely a euro story but a reserve-asset reshuffle that elevates BTC because it is a portable, bearer instrument outside the reach of Eurozone gatekeepers. “The slow-motion collapse of the French state is the signal that it’s time to sell euros and buy Bitcoin,” he writes, later distilling the trade into a binary: “Either the ECB presses the Brrr button now and implicitly finances the French welfare state, or it does it later when French capital controls threaten to destroy the euro. Either way, money gets printed in the trillions of euros.”

As France Breaks The Euro, Bitcoin Becomes The Escape

Hayes treats Bitcoin not as a speculative risk asset but as the neutral reserve standing opposite fiat debasement and capital controls. He frames the immediate hedge as operationally simple for Eurozone savers: “Bitcoin is the best way to preserve options… it is a digital bearer asset. In a few minutes, you can convert your euro bank balance into Bitcoin using a spot exchange on the continent. And voila, you are no longer Lagarde’s bitch.”

That prescription is the capstone to his analysis of France’s TARGET2 deficit and reliance on foreign creditors. With “59% of French OAT government bonds with maturity over one year” and “70% of French long-term bank debt” held abroad, he contends the financing base is fragile. If foreign holders are haircut or flee, he expects the ECB’s response to be large and fast: “If these assets get wiped out, the EU banking system is approaching insolvency on an unlevered basis. To save the EU banking system, the ECB would print EUR 5.02 trillion.”

The central mechanism that connects France’s stress to a BTC bid, in Hayes’s telling, is the acceleration of deposit migration across the euro area’s settlement rails. He points to the shift in national TARGET balances since 2020 to argue that “French savers increasingly do not believe that their euros are safe within the French banking system.”

Once that confidence is impaired, he says, the scramble for exits will narrow toward scarce, self-custodiable assets. “These euros effectively pump Bitcoin and gold as the only two hard assets any investor with a single neuron would purchase in this situation,” he writes, before returning to BTC as the cleanest expression of neutrality: “Bitcoin doesn’t care and will continue its inexorable rise versus the piece of trash that is the euro.”

Hayes pushes the Bitcoin-first framing through multiple contingencies. If the ECB withholds support to discipline Paris, he expects bank stress to worsen and capital to move faster, enriching the BTC bid. If the ECB capitulates early, he expects balance-sheet expansion to debase the unit of account, also enriching the BTC bid. “The ECB will valiantly print money to forestall the loss of its raison d’être,” he writes.

“It shall be a glorious day for the faithful as printed euros will combine with printed dollars, yuan, yen, etc to bid up the price of Bitcoin.” Even a hypothetical French exit and a weaker franc doesn’t alter the destination in his view; it merely shifts the channel through which policy redistributes losses. “Locals who still hold French financial assets still have time to get out… But when they come, you cannot withdraw much in the way of physical euro cash, or wire euros outside of the French banking system, or escape by buying Bitcoin and gold.”

To scope magnitude, Hayes offers directional estimates that emphasize speed rather than precision. He notes “domestic French banking deposits totaled EUR 2.6 tn” as of July 2025 and estimates “25% of this capital could leave within a few days… This amounts to EUR 650 bn.”

Applying the same heuristic to “$3.45 trillion” in equities and “$3.25 trillion” in government bonds, he argues that “hundreds of billions if not trillions of dollars could quickly leave France and find a home in Bitcoin and gold if domestic capital gets spooked.” His caveat is explicit—“Of course, this is a shitty estimate”—but it serves the thesis that flow urgency, not fine-tuned arithmetic, is what matters for BTC’s upside convexity when fiat systems wobble.

The political overlay is instrumental to his Bitcoin call. Hayes portrays the ECB as prioritizing institutional control over currency stability, which, he says, paradoxically intensifies the need for an eventual rescue. “The ECB is so focused on control of Europe™ that it’s cutting off its nose to spite its face,” he writes, arguing that disciplining deficits while French funding frays accelerates deposit migration and forces larger printing later. He collapses that loop back to BTC with a refrain that runs through the essay: “Sell euros and buy Bitcoin.”

For readers outside Europe, Hayes’s guidance does not change with geography; the driver is money creation, not local banking architecture. “If you are not a denizen of Europe™ do not buy European financial assets under any circumstances. Instead, buy some Bitcoin, sit back and watch your sick gainz as printed euros contribute to the bull market in growth of the fiat money supply.” For those inside the bloc, the imperative is timing around potential restrictions: “There are no domestic capital controls yet,” he writes of France. “But when they come… your freedom to escape by buying Bitcoin… will wane rather than wax.”

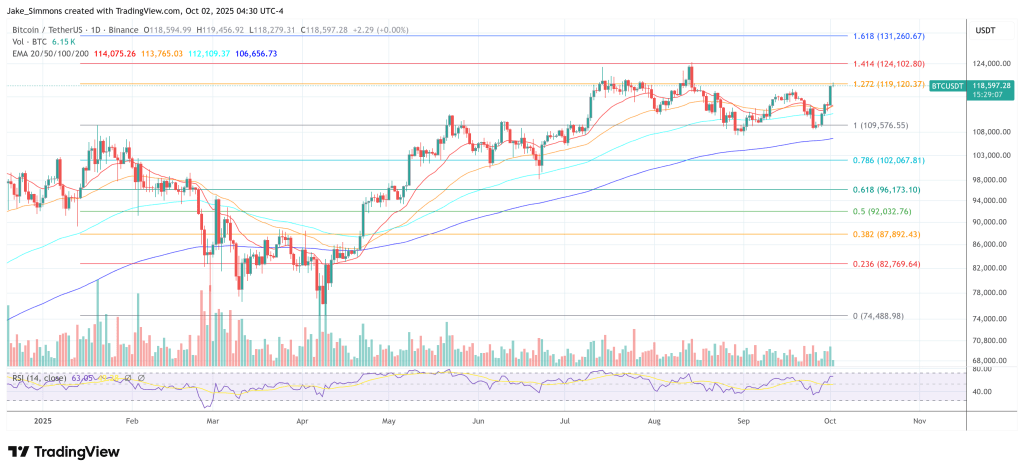

At press time, BTC traded at $118,597.

Featured image created with DALL.E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

#Euros #Death #Spiral #Bitcoin #Reserve #Arthur #Hayes