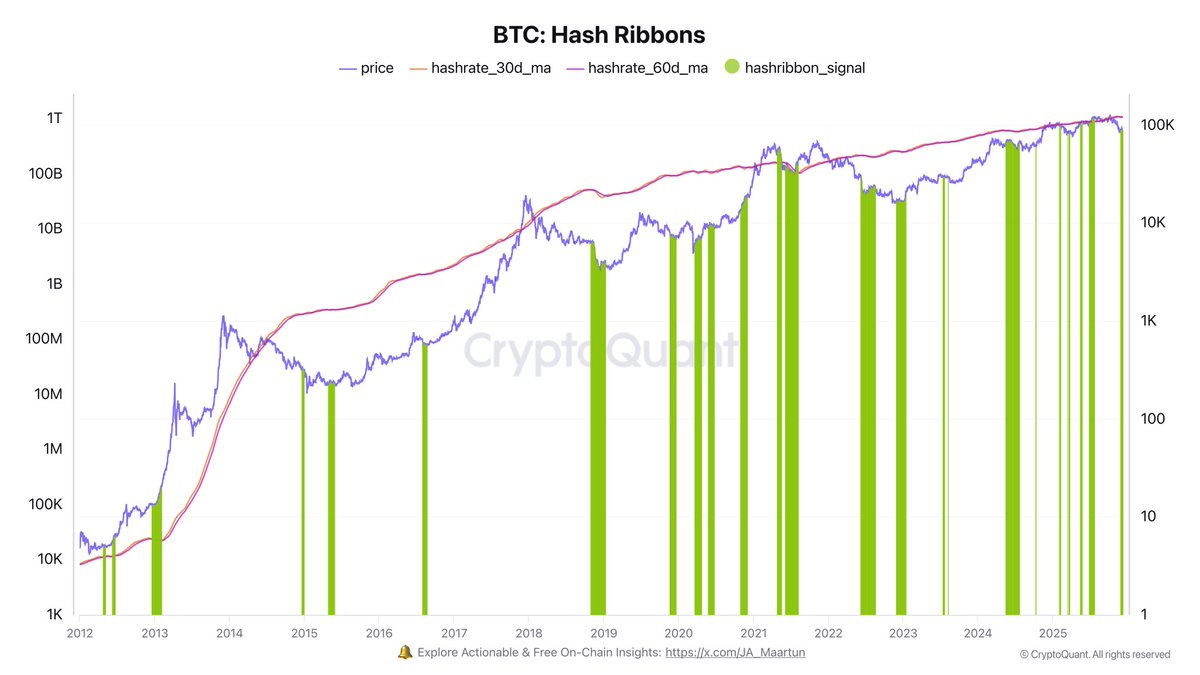

Bitcoin is trading at a decisive moment, holding just above the $90,000 mark after several days of tight consolidation. Despite reclaiming this key level, the market continues to struggle with upward momentum, leaving traders uncertain about the next major move. Yet beneath the surface, a key on-chain indicator has triggered fresh interest among analysts. According to top analyst Darkfost, the Hash Ribbons have just flashed a new buy signal — a development that historically aligns with strong medium-term performance for Bitcoin.

Darkfost emphasizes that this signal is not a cue to rush blindly into the market, but rather a meaningful piece of data worth highlighting. Hash Ribbon signals typically appear during periods of miner stress, when mining difficulty forces weaker miners to shut down.

These moments often precede significant accumulation phases, as selling pressure from distressed miners fades. With the exception of the unprecedented 2021 mining ban in China, every previous Hash Ribbon buy signal has produced profitable outcomes for patient investors.

Understanding The Bitcoin Hash Ribbons Signal

Darkfost explains that the Hash Ribbons indicator is built around the evolution of Bitcoin’s hashrate, comparing the 30-day and 60-day moving averages to detect periods of miner stress. When the 30-day MA of the hashrate falls below the 60-day MA, it signals that mining difficulty is rising relative to miner profitability.

In these phases, less efficient miners are often forced to scale back operations or shut down entirely, reducing the overall network hashrate.

While mining difficulty itself is influenced by several factors — including electricity costs, hardware efficiency, block rewards, and, of course, Bitcoin’s price — the key point is that miner capitulation tends to create short-term selling pressure. Miners may liquidate part of their reserves to stay afloat, often contributing to temporary weakness in the market.

However, Darkfost emphasizes that these periods of stress historically present strong mid-cycle accumulation opportunities. As weaker miners exit and difficulty adjusts downward, the market often enters a healthier phase where selling pressure subsides, and long-term participants begin to accumulate BTC at discounted prices.

Over the years, Hash Ribbon buy signals have frequently marked early stages of major recoveries, offering investors a structural, data-driven advantage even when sentiment appears uncertain.

Testing Support as Momentum Weakens

Bitcoin continues to trade just above the $90,000 level, showing signs of stabilization after several weeks of heavy downside momentum. The chart reveals that BTC has bounced off the 100-day moving average (green), which is now acting as a key dynamic support zone. This level has historically served as an important midpoint during major pullbacks, and the market’s ability to hold above it suggests that selling pressure may be easing.

However, the price remains well below the 50-day moving average (blue), which has begun to curve downward — a signal that short-term momentum still leans bearish. For a stronger recovery, Bitcoin must reclaim this moving average and convert it into support. Until then, rallies may struggle to extend meaningfully.

Volume has also compressed significantly compared to the earlier stages of the uptrend. This decline indicates hesitation from both buyers and sellers, often typical during consolidation phases following sharp corrections. The lack of aggressive selling is a constructive sign, but the absence of strong buy-side interest keeps BTC vulnerable to further swings.

If Bitcoin holds above the $90K–$88K area, it could build a base for a broader rebound. A breakdown below this region, however, would open the door to deeper retracements toward the mid-$80K range.

Featured image from ChatGPT, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

#Classic #Bitcoin #Buy #Signal #Returns #Miners #Hinting #Accumulation #Phase