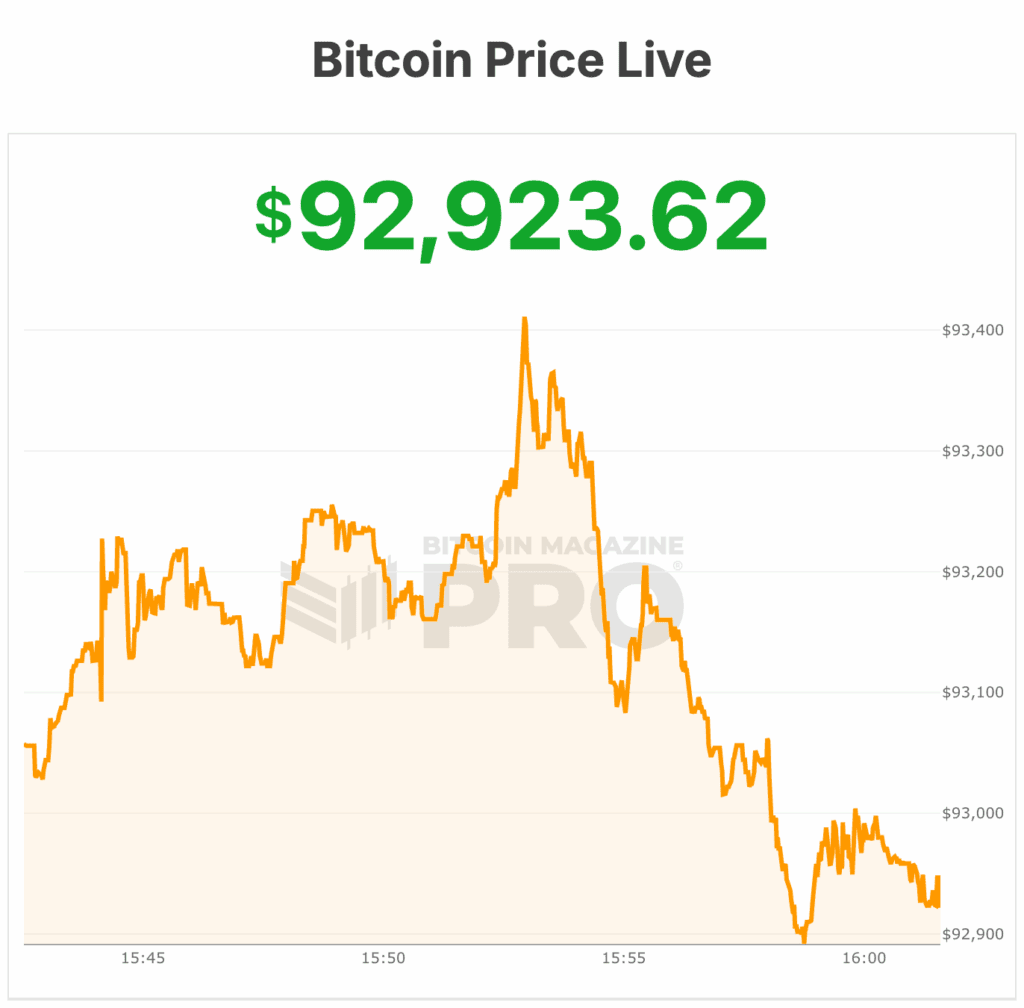

The bitcoin price is trading near $93,000, with roughly $81 billion changing hands in the past 24 hours. The price is up 3% on the day, holding just 1% below today’s high of $93,929 and about 3% above the weekly low near $90,837.

Nearly 19.96 million BTC are in circulation, inching toward the fixed 21 million cap. The move pushed Bitcoin’s global market value to $1.86 trillion, also up 3% over the same period.

According to analysts, the Bitcoin price briefly dipped under its Metcalfe-based fair value for the first time since 2023, signaling what analysts say is a classic late-cycle reset. The move came during a sharp 36% drawdown that dragged the Bitcoin price towards $80,000 last week, erased excess leverage and flushed out speculative positions.

According to network economist Timothy Peterson, periods when bitcoin trades below its fundamental network value have historically produced strong forward returns. Twelve-month gains have averaged 132%, with positive performance occurring 96% of the time, according to CoinDesk reporting.

The network’s internal dynamics have also shifted. Long-term holders accumulated roughly 50,000 BTC over the past ten days, reversing months of steady distribution.

Coins are maturing from short-term traders into long-term storage, reducing sell pressure at a moment when bitcoin is attempting to reclaim higher levels. Bitcoin recovered back above $90,000 this week and traded at highs of $93,978 on Wednesday.

Bitcoin price and macro conditions

Macro conditions are now converging with on-chain signals. The Federal Reserve just ended Quantitative Tightening, with markets pricing a December rate cut as nearly certain.

Historically, each QT reversal has coincided with major bitcoin rallies. The pattern dates back to 2010 and includes the explosive 2013 cycle and the post-2019 surge that eventually carried the bitcoin price to $67,000.

Business-cycle indicators may also be turning. The copper-to-gold ratio, a leading gauge for U.S. manufacturing sentiment and future PMI strength, appears to be bottoming.

Bitcoin’s recent stagnation despite expanding global liquidity suggests investors have been reacting more to weakening economic confidence than to crypto-specific factors. A recovery in risk appetite would likely benefit bitcoin after months of consolidation.

The short-term picture remains fragile. A bearish November close confirmed a monthly MACD cross, a signal that often precedes multi-month periods of slower momentum.

Key levels near $85,000 and $84,000 continue to act as support, while analysts warn that a breakdown could open the door to a deeper test of $75,000.

Bitcoin price remains down sharply from its $126,000 record set in October, though volatility has eased as liquidations subside.

Institutional participation continues to grow despite turbulence. BlackRock increased internal exposure to its IBIT ETF, JPMorgan introduced a structured note tied to the product, and Strategy Inc. expanded its bitcoin holdings while setting aside a $1.4 billion reserve to reassure investors it will not be forced to sell.

Earlier today, Charles Schwab said it also wants to offer Bitcoin trading in early 2026.

Also earlier today, BlackRock CEO Larry Fink said he was “wrong” about Bitcoin, marking a sharp reversal from his past skepticism.

Speaking at the NYT DealBook Summit, Fink called Bitcoin “an asset of fear,” bought during times of geopolitical stress, financial insecurity, or currency debasement. He warned it remains volatile and by leverage but said it can act as meaningful portfolio insurance.

““If you’re buying it as a hedge against all your hope, then it has a meaningful impact on a portfolio… the other big problem of Bitcoin is it is still heavily influenced by leveraged players,” Fink said.

BlackRock now offers major crypto products and is building tokenization tech, with Fink seeing a “large use case” for Bitcoin and digital assets.

Also during the summit, Brian Armstrong, the CEO of Coinbase, said that there is “no chance” of the bitcoin price going to zero.

At the time of publication, the bitcoin price is $92,923.

#Bitcoin #Price #Flirts #Bullish #Setup