Quick Facts:

- ➡️ The market puts the odds of Kevin Hassett becoming the next Fed chair at 84% and waits for Trump to make the announcement.

- ➡️ A crypto-friendly Hassett could revitalize the market and bring more investors in, effectively ending the current bear market.

- ➡️ Bitcoin Hyper uses SVM-based execution to bring scalable smart contracts and DeFi to Bitcoin, offering a higher-octane way to ride a long-term $BTC bull thesis.

- ➡️ $HYPER raised over $28.8M in presale so far and is positioned for a post-launch ROI of 1,396% in 2026 and 11,123% or higher by 2030.

Donald Trump floating former White House economist Kevin Hassett as a ‘potential Fed chair’ is more than a personnel rumor.

Kalshi’s prediction puts the odds at 84% and growing, while The Kobeissi Letter already sees it as a one-and-done, with the mention that ‘2026 is going to be a wild year.’

If confirmed, the arrival of Kevin Hassett at the helm would spell good news for crypto.

A more dovish, crypto-tolerant Federal Reserve would structurally lower the hurdle for risk assets.

Cheaper capital and less aggressive tightening historically favor high-beta trades, from tech equities to altcoins. If Bitcoin is the macro bellwether in this environment, Bitcoin-linked leverage plays could become the next logical step for conviction bulls.

But there’s a catch: Bitcoin’s base layer still processes roughly seven transactions per second, with fees that can spike into double digits during congestion and no native smart contracts.

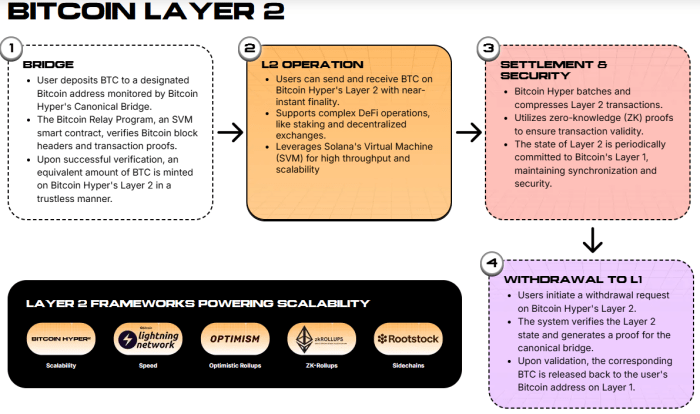

That’s where Bitcoin Hyper ($HYPER) comes into focus. It positions itself as a Bitcoin Layer 2 with Solana Virtual Machine (SVM) integration, designed to give you Solana-style performance and programmable DeFi rails while still anchoring to Bitcoin’s settlement layer.

Read this to learn more about what Bitcoin Hyper is.

Why Looser Fed Policy Supercharges Bitcoin’s Infrastructure Race

A credible chance of a crypto-friendly Fed chair changes the calculus for builders and investors. If rate cuts or a softer stance are on the table, liquidity doesn’t just chase $BTC; it hunts yield, leverage, and new primitives that sit on top of Bitcoin and other base layers.

That’s why Bitcoin scalability and programmability are suddenly core macro trades, not just technical debates.

Lightning Network tackles payments but struggles with UX and liquidity routing at scale. Meanwhile, Bitcoin-adjacent ecosystems like Stacks, Rootstock, and Merlin Chain are racing to bolt smart contracts and DeFi onto Bitcoin without compromising security guarantees.

In this emerging Layer 2 stack, Bitcoin Hyper ($HYPER) is one contender, pitching a modular design where Bitcoin remains the settlement and security anchor while a high-throughput execution layer handles smart contracts.

You can buy $HYPER on the official presale page today.

How Bitcoin Hyper Turns Bitcoin Into a High-Beta DeFi Play

Zooming in, Bitcoin Hyper ($HYPER) markets itself as the first Bitcoin Layer 2 to integrate the Solana Virtual Machine, targeting real-world throughput that can exceed Solana’s own benchmarks while still anchoring state back to Bitcoin.

The core idea: keep Bitcoin as the trust layer, but move execution to an SVM-powered environment optimized for parallel processing and sub-second confirmation.

The result: a faster, cheaper, and more scalable Bitcoin network, attracting more institutional investors and tapping into the mainstream.

By combining a modular architecture – Bitcoin L1 for settlement, an SVM-based L2 for execution, and a decentralized Canonical Bridge for $BTC transfers – $HYPER sidesteps Bitcoin’s biggest constraints: slow base-layer confirmation times, volatile on-chain fees, and the absence of native smart contract logic.

The goal is to enable swaps, lending, staking, NFTs, and gaming in wrapped $BTC with low latency and low cost.

From a market-structure angle, this turns $HYPER into a leveraged bet on Bitcoin’s upside and on-chain usage growth.

The presale has raised over $28.8M so far, with $HYPER sitting at $0.013365, suggesting investors are already positioning for a structurally looser policy backdrop and a richer Bitcoin DeFi stack.

Based on the presale’s performance and Bitcoin Hyper’s utility, we expect the token to hit the market hard.

From a pure numbers’ perspective, $HYPER could become one of the best altcoins to buy in 2026.

The presale targets a release window between Q4 2025 and Q1 2026, depending on market conditions and demand, with the latter already being high. So, if you want in, you should feel a sense of urgency right about now.

Make sure you read our guide on how to buy $HYPER first, though.

Go to the presale page and buy your $HYPER now.

This isn’t financial advice. DYOR and manage risks wisely before investing.

Authored by Bogdan Patru, Bitcoinist: https://bitcoinist.com/trump-kevin-hassett-fed-bitcoin-hyper-presale

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

#Trump #Hints #Kevin #Hassett #Fed #Chair #Reinforcing #LongTerm #Bull #Case #Bitcoin #Hyper