Bitcoin is struggling to hold above the $95,000 level as fear spreads across the market, with traders uncertain whether the recent correction marks the beginning of a broader downtrend or just a temporary shakeout. The leading cryptocurrency has been under sustained selling pressure, wiping out months of bullish momentum and pushing sentiment toward extreme caution.

Analysts remain divided on the next move. Some argue that Bitcoin could be entering the early stages of a bear market, pointing to weakening momentum and growing short-term losses among holders. Others, however, believe that this consolidation phase is setting the stage for a major recovery, with potential for a surge beyond all-time highs once market sentiment stabilizes.

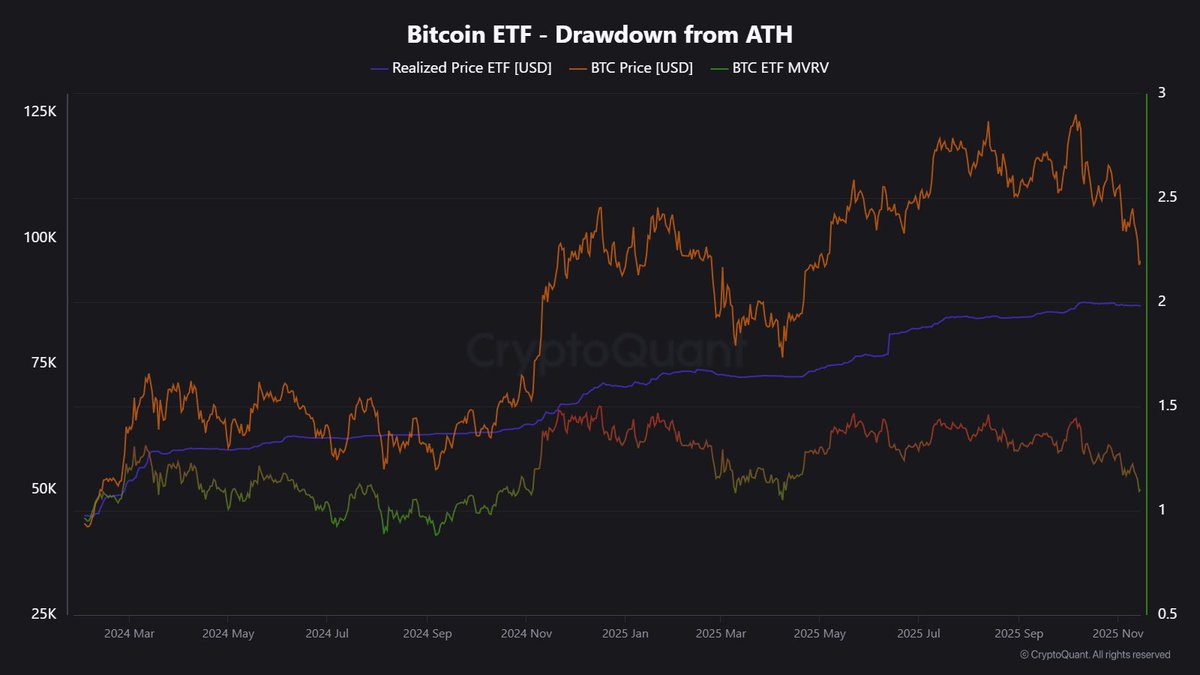

Despite the volatility, on-chain data offers a glimmer of strength. Bitcoin is still trading above the ETF Realized Price, according to CryptoQuant. This means that, on average, ETF investors remain in profit — a sign that institutional demand remains resilient even amid retail fear.

ETF Investors Remain in Profit Despite Market Fear

According to top analyst Maartunn, Bitcoin’s ETF Realized Price — the average cost basis of all spot Bitcoin ETF holders — currently stands at $86,680. Despite the recent wave of volatility and fear-driven selling, Bitcoin is still trading roughly 9% above this critical level, suggesting that most ETF investors remain in profit.

This metric serves as an important gauge of institutional sentiment. The fact that Bitcoin continues to trade above ETF investors’ cost basis indicates that institutional demand remains resilient, even as retail sentiment turns bearish. Historically, when Bitcoin holds above key realized price levels during corrections, it signals underlying strength and reduces the likelihood of a prolonged bear phase.

Moreover, ETF inflows have remained stable, showing that long-term holders are not panic-selling despite price weakness. These investors tend to view market dips as opportunities to accumulate rather than liquidate positions — a stark contrast to short-term traders who often react emotionally to volatility.

If Bitcoin can sustain its position above the ETF Realized Price, it would reinforce this structural support and could serve as the launchpad for a recovery once broader market sentiment shifts from fear to cautious optimism.

Bitcoin Finds Support Amid Heightened Market Fear

The weekly Bitcoin chart shows the cryptocurrency hovering just above $95,000, attempting to stabilize after weeks of consistent selling pressure. This marks the first time since May that BTC has revisited this zone, which now acts as a crucial support level both technically and psychologically. The decline from the recent highs near $120,000 has been sharp, reflecting a shift in sentiment as fear and uncertainty dominate the market.

The 50-week moving average currently sits near $94,000, and Bitcoin’s ability to remain above it could define the next market phase. Historically, this moving average has been a reliable support line during mid-cycle corrections, often signaling accumulation zones rather than the start of prolonged bear markets. Meanwhile, the 200-week moving average — a long-term structural floor — remains far below near $70,000, highlighting that Bitcoin’s macro trend remains intact.

Volume data also suggests a potential capitulation phase, with recent sell pressure accompanied by rising trading activity, indicating stronger hands may be absorbing weak supply. If Bitcoin holds this range, a rebound toward $100,000–$105,000 could follow. However, losing $95K would expose the market to further downside, potentially testing lower supports before stability returns.

Featured image from ChatGPT, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

#Bitcoin #Maintains #Edge #ETF #Realized #Price #Market #Pressure #Details